Expense Tracking Software Solutions: Clarity, Control, and Calm for Every Receipt

Today’s chosen theme: Expense Tracking Software Solutions. Step into a practical, human-first guide to taming receipts, simplifying compliance, and uncovering spend insights that actually move the business forward. Join us, share your questions, and subscribe for smarter expense habits that stick.

Core Capabilities That Matter Day One

Look for automatic receipt capture, OCR with line-item extraction, mileage tracking, card feed imports, policy checks, and clean approvals. These essentials reduce manual work, prevent errors, and make expenses feel less like a chore for employees and finance alike.

Reliability, Auditability, and Peace of Mind

Strong audit trails, immutable logs, and clear document links transform month-end from guesswork to confidence. When every claim traces to a receipt and policy rule, audits feel routine, not dramatic. Tell us your audit stress story and what would help most.

Security and Privacy Built Into the Foundation

Choose solutions with strong encryption, granular permissions, SSO, and regional data residency options. Expense data is sensitive; it reveals patterns about people and vendors. Ask about certifications, and share your must-have security requirements in the comments.

From Spreadsheet Chaos to Streamlined Control

Start with a simple inventory: where receipts live, how approvals happen, who reconciles, and which policies exist only in someone’s head. Document pain points and bottlenecks. This honest map becomes your migration checklist and will help you celebrate progress.

From Spreadsheet Chaos to Streamlined Control

One startup CFO told us adoption clicked only after they hosted a ten-minute demo with real receipts from the sales team. Familiar examples matter. Offer quick wins, set clear timelines, and invite feedback. People support what they help build. Invite questions below.

From Spreadsheet Chaos to Streamlined Control

Pilot with a supportive group, refine rules, then expand. Keep legacy processes alive briefly to reduce anxiety. Communicate milestones and share small victories. When employees see faster reimbursements, the new system stops feeling like change and starts feeling like relief.

Integrations That Make Expense Tracking Software Solutions Sing

Map categories to your chart of accounts, push reimbursements and corporate card postings, and keep vendors tidy. When expenses post cleanly the first time, month-end closes faster. Ask about your accounting stack and we’ll share a practical mapping template.

Policy Automation and Fraud Prevention Without the Headaches

Set thresholds, per diems, preferred merchants, and required fields. Use helpful prompts that explain why something is flagged and how to fix it. Employees learn the policy in the moment, which is far more effective than a dusty PDF on an intranet page.

Policy Automation and Fraud Prevention Without the Headaches

Pattern-based checks catch duplicate receipts, weekend spikes, or unusual merchants. One controller shared that a subtle mileage anomaly revealed a broken workflow, not misconduct. The lesson: anomalies start conversations that improve process, culture, and trust.

Snap a photo and let OCR extract merchant, date, amount, tax, and currency—then match to the right card transaction. When matching is automatic, submissions take seconds, not evenings. Encourage your team to try it after their next coffee receipt today.

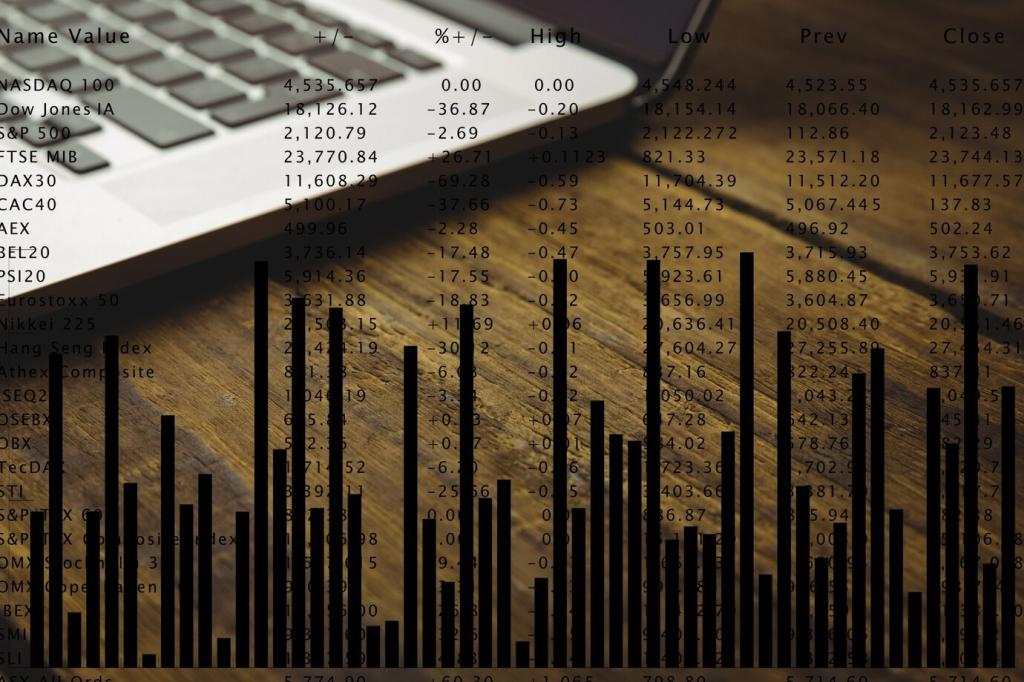

Insights That Turn Expenses Into Strategy

See top vendors, policy exceptions, and aging reimbursements at a glance. Tie spend to departments and initiatives. When leaders see patterns clearly, they make decisions faster and with more confidence. Share your top question and we’ll suggest a metric to track.

Insights That Turn Expenses Into Strategy

Blend historical expense data with planned budgets to predict cash needs. Set alerts when categories drift off target. Transparency encourages teams to self-correct early, before finance has to step in. Want a forecasting template? Ask and we’ll send a subscriber preview.

Choosing the Right Fit: Small Business to Enterprise

Simplicity for Small Teams, Power for Large Ones

Small businesses win with fast setup, intuitive UX, and essentials that work out of the box. Enterprises need custom roles, multi-entity controls, and robust APIs. Identify today’s needs while planning for next-year complexity, avoiding costly replatforming later.

Global Readiness and Tax Nuance

If you operate across regions, verify VAT and GST handling, per diem localization, and currency support. Strong multi-entity reporting prevents consolidation headaches. Share your operational footprint, and we’ll suggest localization features worth testing in a pilot.

True Total Cost of Ownership

Evaluate training time, admin overhead, data migration, and integration maintenance—not just licensing. The right solution pays for itself in saved hours, reduced leakage, and happier employees. Comment with your biggest hidden cost concern and we’ll workshop strategies.