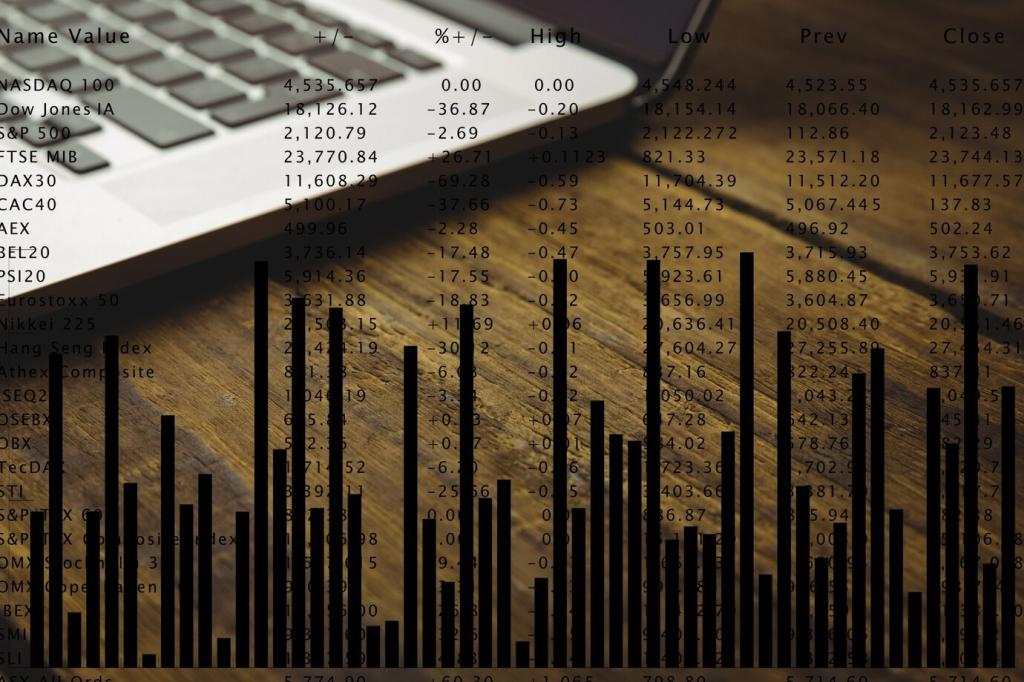

Why Digital Goal-Setting Works

Progress bars, streak counters, and milestone badges create instant feedback, converting distant financial goals into tangible, satisfying steps. Tell us: which visual keeps you motivated, and how often do you check your dashboard?

Why Digital Goal-Setting Works

Gentle reminders, adaptive savings suggestions, and context-aware prompts help you act without feeling overwhelmed. Have you tested different notification schedules? Share what cadence keeps you consistent without alert fatigue.

Why Digital Goal-Setting Works

Platforms translate intentions into repeatable actions through automation and habit stacking. Comment with one routine your app helped you establish—weekly check-ins, automated transfers, or spending reviews—and inspire another reader to start today.